Bookkeeping, tax, & CFO services for startups & small businesses

Most small business accounting services also offer the option to import existing lists from CSV and XLS files. A good small business accounting service gives you information that helps you answer these questions based on the input you supply. Instant search tools and customizable reports help you track down the smallest accounting and bookkeeping service for startups details and see overviews of how your business is performing. Mobile apps and websites give you access to your finances no matter where you are. Kruze Consulting is a leader in Finance as a Service (FaaS), offering outsourced, integrated services that include a full range of financial services through a single provider.

- Wave follows standard accounting rules and is especially skilled at invoicing and transaction management.

- They set up our books, finances, and other operations, and are constantly organized and on top of things.

- We recommend FreshBooks for sole proprietors and companies with perhaps an employee or two—though it’s capable of handling more.

- FreshBooks can help by keeping your accounting systems organized, allowing you and your tax professional to find all the information when you need to file.

- Being able to communicate with the provider that is doing your bookkeeping, taxes, or accounting can eliminate some of the headaches of startup financial management.

For mature businesses

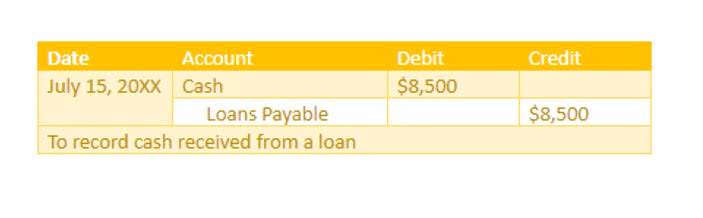

Especially as a founder, you need to know what your expectations are and how you’re doing against your expectations. We talk to hundreds of startups a month – and about 10% of them don’t need a monthly accountant. Instead, they are small enough to DIY their accounting, with the exception of filing a tax return – using a legit CPA for a startup tax return is a very, very good idea. A general ledger is a compilation of entries detailing each of your business’s financial transactions.

Creating Accounting Records for Contacts and Products

Her team handles the books for startups that have collectively raised billions in venture capital funding. With reasonable, fixed fee pricing plans, startups can get CPA level expertise for the cost of what most technology enabled bookkeeping service providers charge from Kruze. Kruze uses a proprietary software that plugs into QuickBooks and it categorizes about 70% of the transactions, and automatically. And we complement that automated bookkeeping with high-quality staff accountants. When you have your vendors labeled, you can actually run reports by vendor and see exactly what you’re spending. We generally recommend that businesses move away from spreadsheets and into an accounting software as soon as possible.

The Best Small Business Accounting Deals This Week*

- Record templates vary in complexity, so you need to understand the differences before you go with one accounting service or another.

- We have developed highly automated systems, and our team is experienced handling the nuances of early-stage, venture funded companies.

- So if you are raising money, especially from professional or experienced investors, you’ll need to choose a Delaware C Corp as your entity type.

- You can also match related transactions, such as an invoice entered into the system and a corresponding payment that has come through.

As your startup grows and makes more revenue, your recordkeeping system will become more complex and crucial to maintain. This is why starting with a well-organized system as you run your business is essential. You can use simple and intuitive accounting software for startups to automate the accounting process and get an up-to-date view of your cash flow. One of your best choices is to try FreshBooks accounting software for free.

This probably involves categorizing the “transaction” in a way that makes sense, say a payment to your payroll provider as a payroll expense. Access all-in-one financial management, including bookkeeping, accounting, and tax services. Xendoo offers a variety of financial services for startups and small businesses, including bookkeeping, tax https://www.bookstime.com/ preparation, and fractional CFO services. QuickBooks Live is a virtual bookkeeping service that offers guaranteed services by real QuickBooks-certified bookkeepers. To start, a bookkeeper will review your startup’s books and update them, as well as conduct a detailed review of your transactions to ensure they are cataloged correctly.

So, here are the basics of bookkeeping for startups – in particular, early-stage companies that have or are going to raise outside venture capital or seed funding. Kruze Consulting is 100% focused on helping seed and venture funded businesses, and one of our key services is accurate and affordable bookkeeping for startups. While some businesses opt for an in-house or staff bookkeeper, online bookkeeping typically provides the same service at a fraction of the cost. Since this service is built for fast-scaling startups and growing businesses, its platform is equipped to handle all of the finance management needs of a business built to scale. We work with hundreds of SaaS companies to keep them running smoothly. If you need an easy-to-understand accounting software package with great customer service and tech support, FreshBooks can help.

Vendor Management Support

Our premium package offers access to strategic expertise from professionals that understand your startup’s needs. Our timesaver package will provide you with a proactive partner who will handle your accounting needs while you focus on business. Sign up below to receive our free eBook on accounting, finance, and tax topics that every startup needs to be aware of to help avoid surprises and headaches down the road. Our accountants are board certified and stay current with continuous certifications and seminars to ensure we are up-to-date on all of the newest information, laws, regulations, and techniques in our field. We’ve worked with hundreds of high-growth companies over 10 years, acting as their back-office function until they are ready to hire an in-house team. Once you have a customer record and start creating invoices, sending statements, and recording billable expenses, you can usually access historical activities within the record itself.

- You should be printing a set of financial statements monthly or quarterly, depending on your business.

- A bookkeeper typically focuses on processing and recording transactions, including things like invoices, receivables, payments, and other essential functions.

- While many startup founders choose to hire an accountant, it is possible to do accounting yourself or by using accounting services.

- However, once you do, those returns must be filed away and kept for at least three years, although it may be a good idea to keep them longer.

- Choosing an accounting program that can help you organize everything in one place is invaluable.