Operating Expense Ratio Formula: Accounting Explained

The largest mutual funds have expense ratios that often remain the same from one year to next, even if the long-term trend has been downward. The gross profit margin, operating profit, and net profit margin ratios are the most commonly used measurements of business profitability. Net profit margin reflects the amount of profit a business gets from its total revenue after all expenses are accounted for. Operating profit reflects the profit from the company’s core operations including sales, general and administrative expenses, and gross profit margin indicates profit that exceeds the cost of goods sold.

What are some strategies for minimizing expense ratios in an investment portfolio?

If a company has a high P/E ratio, that may mean its share price is high relative to earnings, potentially making it overvalued. A low P/E, on the other hand, may indicate its stock price is low relative to its earnings. Each week, Zack’s e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. Jeff Clements has been a certified public accountant and business consultant since 2002. Clements founded a multi-strategy hedge fund and has served as its research director and portfolio manager since its inception.

Do you own a business?

The income statement is one of the four primary financial statements companies issue. The income statement shows gross sales revenue at the top, followed by various categories of expenses that are itemized and deducted, resulting in net income, or the bottom line. You’ll need to locate the what is a balance sheet forecast fund’s operating expenses in its financial statements and net assets on its webpage (or financial statements). Operating expenses reduce the fund’s assets; they reduce the return to investors because the expense ratio is deducted from the fund’s gross return and paid to the fund manager.

Historical performance of JPMorgan Nasdaq Equity Premium Income ETF (JEPQ)

Profitability ratios can be a window into the financial performance and health of a business. Ratios are best used as comparison tools rather than as metrics in isolation. In order to figure out the profit margin, you need to divide net income after tax by net sales. You’ve got incredible products, a fantastic team, and a loyal customer base. By now, you know that CRR estimates the balance between your costs and revenue.

Increasing Sales Revenue

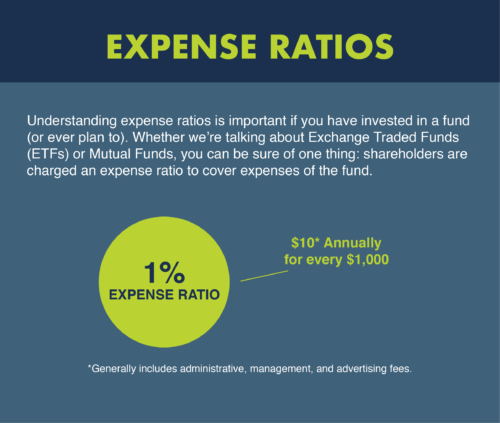

However, it’s important to note that many investors choose to invest in funds with high expense ratios if it’s worth it for them in the long run. The operating expense ratio formula is used heavily in the real estate industry. (!) Keep in mind that the expense-to-revenue ratio should be considered in the context of the specific industry, business model, and growth stage of the company. It serves as a tool to evaluate performance and guide strategic financial decisions for sustainable growth and profitability.

Hopefully, the fund earned at least 4 percent for the year, so you didn’t lose money on your investment. A professional money manager must actively monitor the invested assets, research new investments, and make sure the fund is investing according to its goals. The fund must also maintain an office with a staff to mail monthly, quarterly, and annual statements to investors. Tax professionals must also be hired to file the tax returns for the fund and issue reports for each of the investors.

The Operating Expense Ratio is the ratio between the cost of operation to the net revenue. It is typically used in evaluating real estate properties, where a higher Operating Expense ratio means higher operating expense than its property income and serves as a deterrent. Therefore, a lower operating expense ratio implies lower operating costs and is preferable and investment-friendly. As you can see, the percentage of total assets that must be paid out to run the fund is four percent. Taking this a step further, we can see that you will have to pay $4,000 for your share of the operating expenses.

- You will then understand which offerings are more cost-effective and profitable.

- Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

- Another way to view this is that the company has $1 in profit for every $10 in sales, which translates to a 10 percent net profit margin.

- This JPMorgan ETF might be an attractive option for investors seeking income while maintaining exposure to the tech-heavy Nasdaq-100.

Then make a total of all such expenses for the numerator of the formula. A higher ratio indicates that more expenses are incurred to manage a set amount of assets. A lower ratio indicates that less are expenses are needed to measure the same amount of assets. In other words, management is doing a more efficient job at operating the fund. It’s the ultimate gauge of how well you manage your expenses relative to the revenue you bring in.

A company’s operating margin equals operating income divided by net sales. This is used to show how much revenue is left over after paying variable costs such as wages and raw materials. It is the same as the company’s return on sales, and indicates how well that return is being managed.